Do you know where your time goes during a workday? Every hour is valuable for business owners or professionals, and every minute counts towards your bottom line. But not all hours are created equal. Some tasks may be essential but don’t directly generate revenue, while others are billable and directly contribute to your income. This is where tracking non-billable time comes in.

This article will explore what non-billable time is, how it differs from billable hours, and why tracking it is crucial for your business’s success. We’ll also share tips and tools to help you reduce non-billable time and maximize profitability. So, buckle up and get ready to learn how measuring non-billable hours can take your business to the next level.

Throughout this write-up we’ll discuss:

- What is Non-billable time?

- How Do Non-billable Hours Differ from Billable Hours?

- What Are The Common Non-billable Activities and Why Are They Non-billable?

- What Are The Benefits of Tracking Non-Billable Time?

- Best Tools to Track Non-Billable Time

- Wrap-up: Measure Non-billable Hours for Business Success

What is Non-billable time?

Non-billable time is your hours on activities that don’t directly generate revenue. This includes administrative tasks, meetings, training sessions, and other non-revenue-generating activities.

Keeping track of these hours is essential because they can add up quickly and detract from your overall profitability. Non-billable time can also be a source of inefficiency if it isn’t managed correctly.

How Do Non-billable Hours Differ from Billable Hours?

Billable hours directly contribute to your revenue, such as consulting with clients or working on projects. Non-billable time is everything else, like administrative work and meetings.

The critical difference between the two is that non-billable hours don’t generate any money for you or your business, while billable hours do. This distinction is crucial because it helps you understand where your time goes during a typical day and how much is going toward making money.

Billable activities include:

- Consulting with clients

- Working on projects

- Researching and creating content

- Writing emails or reports

- Creating presentations or spreadsheets

What Are The Common Non-billable Activities and Why Are They Non-billable?

There are several everyday non-billable activities that you would have to carry out. We’ll now run through some of the most common non-billable activities, so you can identify and track them in your business.

1. Planning & Making Strategy

Planning and making strategies are essential no matter what project, task, or assignment you’re working on. You need to know your goals, plan how to achieve them, and use planning tools to devise a timeline for completion. This is usually one of the first steps in any project, and it can take up considerable time without directly generating revenue.

Despite the activity being non-billable, it tremendously contributes to the success of your business. You need to understand and plan the steps toward achieving success with any project or task, so allocating some time for this activity is necessary.

- Making a timeline

- Researching the project and related tasks

- Creating a budget

- Developing strategies for success

- Writing documents that outline the plan of action.

2. Training & Development

Before beginning any project, having all the necessary skills and knowledge is crucial. This includes training your team on the tools they will use or developing their existing skill set with new techniques.

Any activity related to improving an employee’s ability to do their job better is considered non-billable time. While these activities don’t directly generate profits, they are essential for a business’s success in the long run. Having well-trained employees helps ensure projects are done efficiently and correctly, which translates into higher productivity and profitability.

3. Research

Adequate research leads to better decisions and more efficient execution. It also ensures that you clearly understand the project before you start working on it. But research takes time and is usually not billable unless specified in the contract terms.

Research can include reading industry blogs and articles to gather customer feedback or surveying your target audience. All these activities are essential for making informed decisions but may not directly generate revenue, so they’re considered non-billable hours.

Whether you can bill for research depends on your working agreement with a client. You can charge for these hours if research is part of the contract. But if it’s not mentioned in the agreement, they will remain non-billable hours and should be tracked separately.

4. Networking & Connecting with Prospects

One of the core activities of any business is to reach out and connect with potential customers. This involves connecting with prospects on social media or through emails, attending events related to your industry, participating in webinars or conferences, and more.

These activities generate revenues in the long run but take up much time. You may spend hours reaching out to prospects, but the revenue generated from these activities will not be immediate. This is why many businesses track their non-billable time spent on networking and connecting with opportunities.

If you know how much time you spend on outreach, you can evaluate the success of your efforts and determine if it’s worth investing more time in this activity.

5. Invoicing and Bookkeeping

Whenever you’re working on a project, you must keep track of your billable hours, invoices, and payments. This non-billable activity requires significant time but is necessary for running a successful business.

You need to record all the details about each project, such as the start date, estimated completion date, and billing rate. You must also keep track of any changes in the scope or timeline to accurately invoice clients with an itemized breakdown of all your charges. Bookkeeping also involves tracking expenses like office supplies and other overhead costs required for operations.

Losing track of invoices and payments can lead to delays in payment or, worse, unpaid bills. Automation software can streamline the process and reduce time spent on bookkeeping.

6. Marketing & Advertising

Marketing and advertising are essential for any business to reach its customers. These activities include creating content, designing websites, running campaigns, or finding new promotion channels.

While these efforts can generate revenue in the long run, they do not directly contribute to it in the short term. This is why marketing and advertising activities are considered non-billable time. However, if you want your business to thrive and gain visibility in this highly competitive market, investing some time into these activities is necessary.

7. Customer Service

Customer service is a critical aspect of running any successful business. If customers have questions or need help, they expect timely and helpful responses from your team. This activity may not be billable, but keeping your customers satisfied and loyal is essential.

In addition to responding to customer inquiries quickly, you must stay up-to-date with industry trends and information that can help you better serve your customers. Researching customer feedback, researching competitors’ products or services, and creating surveys for customer satisfaction ratings — are all non-billable activities that contribute significantly to your company’s success.

Traveling is also a non-billable activity but can help you build relationships with customers and vendors. Whether attending conferences or visiting clients in person, these activities are essential to maintain customer loyalty and increase your business’s visibility.

5 Benefits of Tracking Non-Billable Time

Tracking non-billable time can be beneficial for both the business and its employees. Here are some of the main benefits:

1. Find Opportunities of Billable Hours

Tracking non-billable time allows you to identify potential sources of billable hours. Analyzing how much time your employees spend on administrative tasks, marketing activities, and other non-billable tasks makes it easier to find opportunities for more billable hours.

For example, if you notice that a significant portion of your employee’s working hours is spent on research work for a client, you can try to include the research work in your billing process and charge for it. This can help you generate more income without increasing the actual hours worked.

2. More Accurate Insights of Productivity

You may think that non-billable hours are a waste of time, but this isn’t necessarily true. While reducing the non-billable time for more profitability is crucial, tracking these activities provides valuable insights into your employees’ productivity and the effectiveness of their working processes.

By monitoring the time spent on various tasks, you can identify areas where employees may need more training or help from other staff members to increase efficiency. This can help you optimize how your team works and ensure everyone is maximally productive.

3. Avoid Inefficient and Non-essential Activities

Tracking non-billable time can also help you identify activities that take too much time but don’t generate value. For instance, if you notice that your employees are spending a lot of time on social media or other non-essential tasks, it’s an indicator that they need more direction and guidance to stay focused.

By tracking the non-billable hours, you can alert them when they stray off task and provide better guidance to ensure their working hours are optimally spent.

4. Optimize Business Processes

A clear understanding and overview of non-billable activities can help you optimize business processes and identify improvement areas. This is especially important for businesses scaling quickly, as it allows them to adjust their internal processes to manage the increased workload more efficiently.

Tracking non-billable time also provides insights into how employees spend their working hours and which tasks take up most of their time. This information can streamline operations and ensure maximum efficiency in all aspects of your business.

5. More Profitability through Better Negotiation

Tracking non-billable time can also help you negotiate better terms with your clients. Having accurate insights into how much time is spent on each task, you can estimate the project’s cost and charge accordingly. This ensures that you get paid for all the valuable work done by your employees while providing more value to your clients. For example, you may negotiate a fixed charge for a project rather than an hourly rate.

In addition, tracking non-billable time can help you identify areas where your team may be overworking and negotiate better payment terms or increase the scope of work accordingly.

Best Tools to Track Non-Billable Time

Measuring non-billable hours is vital to understanding where your time is going and how it affects your business’s success. Fortunately, several great tools can easily help you track and analyze non-billable time.

Let’s run through our top picks:

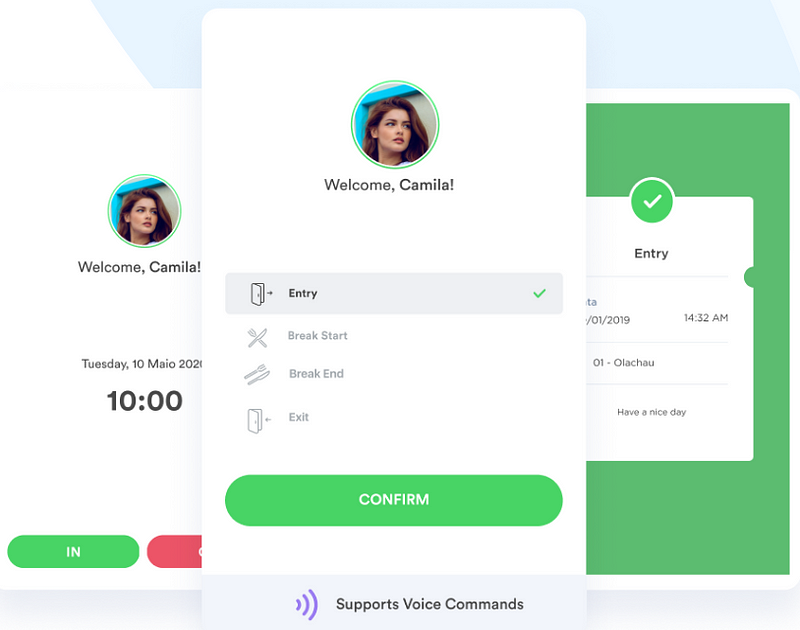

1. Day.io – Overall the Best App to Track Non-billable Hours

Day.io offers comprehensive solutions for tracking non-billable time. This cloud-based tool allows you to record, measure, and analyze every minute of your workday. It also provides easy access to detailed reports that will enable you to see where your time is going and identify areas of improvement.

Day.io also has several project management features, such as task tracking and scheduling. This makes it easy to stay organized and ensures your non-billable activities aren’t interfering with your billable hours.

Features

- Time tracking with billable and non-billable hours identification

- Cost and billing reports and insights

- Task tracking and reminders to keep everyone on the same page

- Robust analytics to measure performance, profitability, and more

- Project reports for accurate progress and productivity tracking

- Easy-to-use employee scheduler to ensure a smooth business process

- Data export capability for further analysis

- Secure cloud storage of all data with secure access control

Pricing

- Project and time tracking: $6 per user/month

- Time and attendance tracking: $4 per user/month

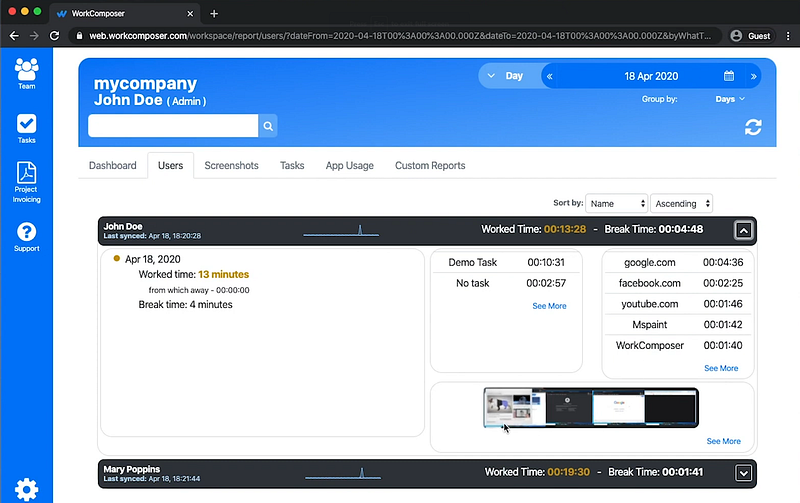

2. WorkComposer – Excellent for Activity Monitoring

WorkComposer is a great tool for tracking and analyzing non-billable time. You can conveniently log your work hours and activities and review detailed reports that provide valuable insights into your non-billable time.

The app also allows you to track multiple projects simultaneously, so you can easily find out which activities are generating revenue and which are not. Additionally, WorkComposer’s interactive dashboard makes it easy to spot trends in your data and adjust accordingly.

Features

- Generating accurate productivity insights

- Monitoring online activities

- Capturing employee screens

- Data synchronization

- Tracking non-billable hours and overtime

Pricing

- Starts from $2.99 per user/month

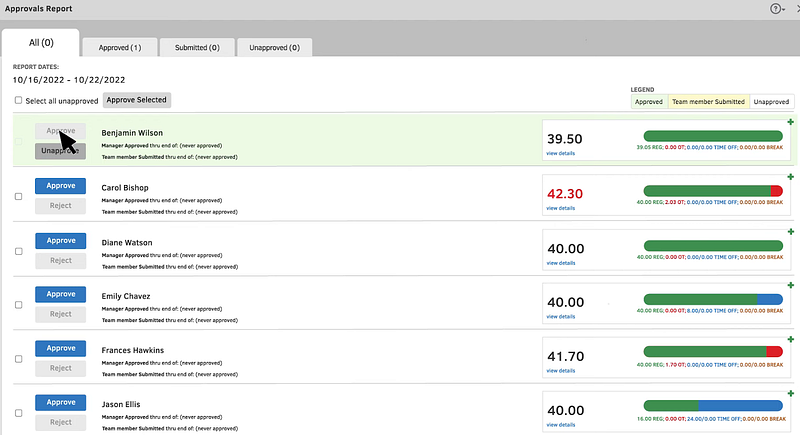

3. QuickBooks Time – Gives Valuable Insights on Profitability

QuickBooks Time is an ideal tool for tracking non-billable time and managing finances. It allows you to easily capture all your time entries, including billable and non-billable ones. You can also use the app to manage invoices, track expenses, and generate detailed reports that provide valuable insights into profitability.

Features

- Cross platform and multi-device support ensuring easy accessibility

- Punch card and manual timesheet for tracking time

- Real-time reporting of employee

- Managing payrolls, billing and invoices against tracked time

- Seamless integration with existing bookkeeping software including QuickBooks

Pricing

Base price $20/month, plus $8 per user/month for the premium package.

Wrap-up: Measure Non-billable Hours for Business Success

Non-billable hours may not be directly generating income, but they are essential for the success of your business. Tracking non-billable time helps you identify where and how you are spending your time during a workday. With the right tools, you can gain valuable insights on how to increase productivity and maximize profitability.

Day.io is the ideal choice for reducing non-billable time and increasing profitability. Sign up today for Day.io to start tracking your non-billable hours.