In 2022 there are software programs to help automate every single aspect of your business, from lead generation and marketing, to sales and accounting. But there’s one area of business that often falls behind when it comes to automation: payroll.

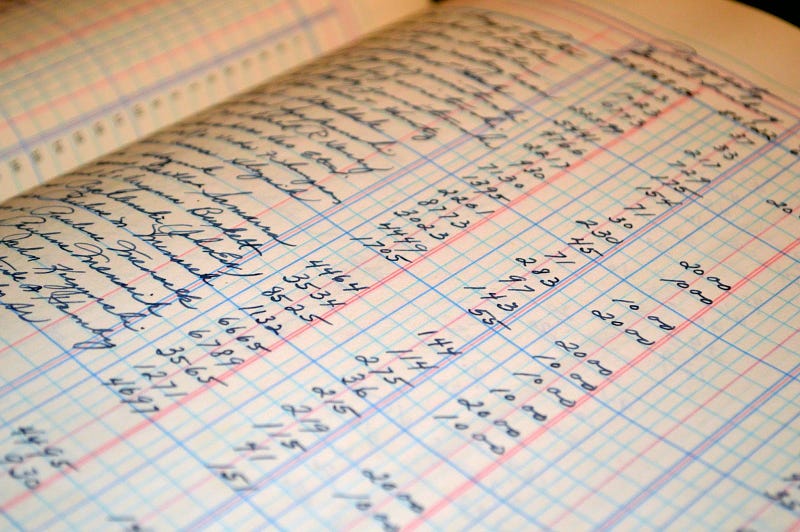

According to Workest, 25% of small businesses still insist on using pen and paper to manage their payroll. Not only is this incredibly time-consuming and prone to human error, it can also be expensive when mistakes are made.

Fortunately, there’s a better way. Payroll software is designed to help you automate your payroll processes, making them faster, more accurate and easier to manage. In this article, we’ll take a look at the benefits of using payroll software in 2022.

We’ll be discussing:

- What is payroll software?

- How payroll software works

- The benefits of using payroll software in 2022

- What payroll software can do for you

- How to choose the right program for your business

- What to look for in a quality app

- The best payroll apps available in 2022

- Implementing a high-efficiency payroll solution

Let’s dive in!

Payroll software: what is it?

Many people still refer to payroll as ‘bookkeeping’. This denotes the historical roots of the process, which began with manual record-keeping of monies paid to employees and taxes withheld. Records were kept in actual books, hence the name.

In 2022, however, payroll has become a complex and sophisticated process that requires specific software in order to manage it. Payroll software automates the calculation of wages, deductions, and tax withholdings, as well as providing reports for both employers and employees.

Payroll software is a tool that allows employers to manage their payroll processes more efficiently and effectively. It can save time and money, as well as improve communication between employers and employees.

These software programs carry out the following tasks:

- Calculate wages, deductions, and tax withholdings

- Produce reports for employers and employees

- Store employee data

- Process paychecks and direct deposits

- Handle tax filings

Without the use of payroll software, businesses would have to rely on manual calculations, which can be time-consuming and error-prone. Payroll software automates these processes, making them more accurate and efficient.

How payroll software works

When chosen and implemented effectively, your payroll software solution becomes a true workhorse for your business. It automates and manages the entire process of employee payroll, from hire to retirement. It interfaces with your organization’s accounting software, automating paycheck calculations and payments, tax filing and other compliance functions.

The way these solutions work is multi-layered:

1. Employee data is entered into the software, including name, Social Security number, address, job title and so on.

2. The software then interfaces with federal and state tax authorities to ensure your company is in compliance with all regulations governing withholding and payments.

3. Automated calculations are made for each employee’s paycheck, taking into account factors like overtime, bonuses, deductions and more.

4. Checks or direct deposits are generated according to your company’s preferences.

5. Records of all employee transactions are kept in an easily accessible format.

Think of payroll software as an indispensable assistant that handles all the complex and time-consuming tasks related to employee pay. By automating these processes, you save yourself hours of work each week — valuable time that can be used to grow your business.

The benefits of using payroll software in 2022

If you’ve ever used an Excel spreadsheet to calculate your employees’ paychecks, you’ll know how much of a relief it is to have all the calculations handled for you. Payroll software goes even further than that, providing a host of features that make managing your employees’ paychecks simpler and more accurate.

Some of the perks of using payroll software are:

- No more tedious calculations by hand — the software will do all the hard work for you

- Easier to keep track of employee wages, deductions, and tax information

- Faster and more accurate payroll processing

- Automatic calculation of employer contributions to social security and Medicare

- Ability to generate detailed reports on employee earnings, taxes, and deductions

And, as you’ll learn over the duration of this article, there are a number of powerful processes that payroll software offers which can take your business to the next level.

What payroll software can do for you

In 2022, payroll software will be even more important as businesses face increasing compliance demands. Here are some of the ways that using payroll software can help your business stay compliant:

1. Automated tax calculations and filings

Employment tax is something you must get absolutely right as a business, or else you run the risk of facing penalties from your governing body. Payroll software can automate all the complex calculations required for employment tax, ensuring that your filings are always accurate.

2. Automatic updates for payroll changes

In 2022, the minimum wage will have increased in many states, and new tax laws will have gone into effect. With payroll software, you can be confident that all of your payroll calculations will reflect the most up-to-date changes in the law.

3. Employee onboarding and tracking

When you’re new to a business, one of the most confusing things is understanding who does what and where to find their contact information. Payroll software can make this process much simpler by automatically adding new employees to the system and tracking their onboarding progress.

4. Employee benefits management

In 2022, employee benefits will be even more complex than they are now, with new rules and regulations governing things like healthcare and retirement savings. Payroll software can help you manage all of your employees’ benefits easily and accurately.

5. Employee payroll reports

As a business owner, you need to be able to track your expenses and revenue closely. Payroll software can generate detailed reports on employee pay, showing you exactly how much money you’re spending on salaries each month.

6. Integration with accounting software

If you’re using accounting software to manage your finances, it’s important that your payroll software can integrate with it. This will allow you to easily track your expenses and revenue side-by-side.

7. Cloud-based software

In 2022, more businesses will be moving to cloud-based software solutions. Payroll software is a perfect candidate for this, as it can be accessed from anywhere with an internet connection. This means that you can manage your payroll from any computer or mobile device.

How to choose the right program for your business

Starting out with a payroll software solution isn’t as simple as downloading the first package you see. You need to take a number of factors into account to ensure not only that the software will meet your needs, but that it’s also compliant with government regulations.

When looking for your ideal payroll software program, ask yourself the following questions:

- How many employees do you have?

- Do you need to track vacation days or sick time?

- Are there any specific government regulations that your software must comply with?

- What types of reports or invoices do you need to generate?

- How often do you need to generate reports or invoices?

- Do you need to interface with other software programs?

Once you have a good idea of the features that your ideal payroll software would offer, it’s time for a little research. The best way to start is by reading reviews of different software programs. Pay attention to the features that are most important to you, and make sure that the program you choose can meet your needs.

The next step is to actually try out a few different programs. Most software companies offer free trials or demo versions of their programs, so take advantage of them! This will give you a chance to see how the software works in practice and whether it’s easy to use.

Finally, consult with an accountant or other financial professional. They’ll be able to tell you whether the payroll software you’re considering is compliant with government regulations, and whether it has any other features that could be helpful for your business.

What to look for in a quality payroll app

When searching for your ideal payroll tool, look for the following desirable traits:

- Ease of use. The software should be easy to navigate, even for those who are not tech-savvy. All the features and functions should be self-explanatory.

- A variety of payment options. The app should allow you to pay employees via direct deposit, checks, or prepaid debit cards.

- Comprehensive reporting. The software should generate detailed reports on employee earnings, hours worked, taxes paid, and more. This information can help you stay compliant with government regulations and optimize your payroll processes.

- Security features. The app should include security measures such as password protection and data encryption to keep your employee information safe and confidential.

- Affordable pricing. The software should be affordable for small businesses without sacrificing features or quality.

Alongside these, you want to make sure that the payroll software can grow with your business. It should offer a variety of customization options and integrations with other business applications to make managing your finances easier.

The best payroll apps available in 2022

It’s always best to do your own thorough research into the different payroll software programs that are available. However, here are three of the most highly rated and recommended payroll apps in 2022:

Xero Payroll

Known for its user-friendly interface and comprehensive features, Xero Payroll is a top choice for small businesses. It offers cloud-based payroll processing, automatic tax calculations, and direct deposit capabilities.

Gusto

Gusto is another popular payroll software program that is ideal for small businesses. Its comprehensive features include automatic tax calculations, direct deposit, and employee self-service. Plus, Gusto offers a free trial, so you can try it before you buy it.

Paychex Flex

If you’re looking for a payroll program that can accommodate businesses of all sizes, Paychex Flex is a good option. It offers a wide range of features, including automatic tax calculations, direct deposit, and employee self-service. Plus, Paychex Flex is backed by the reputation and resources of Paychex, one of the largest payroll providers in the country.

Other payroll software to look at in 2022 include:

- QuickBooks Payroll

- ADP Payroll

- SurePayroll

Implementing a high-efficiency payroll solution

Once you’ve found your payroll software, the hardest part is over — or is it? Actually implementing the software can be a daunting task. You have to make sure everyone in your company is using it correctly, and that means training everyone on how to use it.

There’s no question that implementing payroll software can save you time and money. The efficiency gains you achieve by automating your payroll processes can be significant. But don’t forget the importance of getting everyone up to speed on how to use the software.

Without proper training, your company may not see all the benefits that payroll software can offer. In some cases, employees may even resist using a new system. That’s why it’s so important to make sure that everyone understands how the software works and what it can do for them.

Other important implementation steps include:

- Making sure you have the right hardware and software in place

- Configuring the software to meet your specific needs

- Testing the software to make sure it’s working correctly

- Creating any necessary reports or forms

- Training your staff on how to use the software

Once you’ve completed all these steps, you can start enjoying the benefits of payroll software. Automating your payroll processes can save you time and money, and make your business more efficient — so rest assured that you’ve made an excellent decision in implementing a high-efficiency payroll solution.

Final thoughts on payroll software in 2022

The way of the business world is always changing. What was once cutting-edge and necessary for success is now old news. Payroll software is no different. Just a decade ago, this software was seen as a must-have for all businesses; however, in 2022, that is no longer the case.

With the incredible benefits it has to offer, payroll software should almost be considered critical to the running of a business. Hopefully this article has set you on the path to finding a payroll software that can work for your unique needs!